Risk portfolio management

Development of a reporting tool to manage lost receivables

Lekkerland Deutschland GmbH & Co. KG is a full-service company specialising in strategic convenience sales-channels. It is characterised by a broad product range and supplies numerous trading partners, such as filling stations, kiosks and specialty-beverage shops. In 2007, revenues amounted to €6.7 billion. Lekkerland employs 3,888 people in its 18 branches and in its headquarters in Frechen, near Cologne (www.lekkerland.de).

Initial situation

Lekkerland has served clients with different default rates. Accounts receivable were divided into problem-free accounts, individual accounts with credit insurance, and small accounts. While the loss of receivables was generally small, it was significant in comparison to the company’s profit margins.

Challenge

The risks and default rates varied between client segments, which is why identifying the clients’ respective default risks and an active management of the credit risks could help further reduce the amount of bad debt. The goal was to reduce the loss of receivables. To that end, a model to manage risk portfolios was to be developed and subsequently implemented as a software reporting-tool.

Approach

- The risk of the client segment was analysed according to selected criteria, and past negative cases were examined in detail.

- A client scoring system was developed to divide the clients into risk groups.

- Risk-reducing measures that can be applied during payment problems were developed.

- Approaches were developed to implement company risk assessment.

-

A reporting tool was programmed on the basis of the results.

Results

- The risk-prone client segments were identified using the risk-analysis criteria.

- Effective measures to reduce the number of bad debts were adopted.

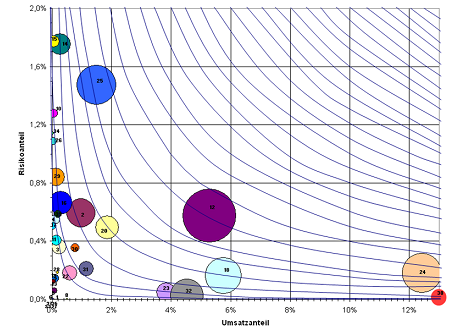

- The risk development of the different client segments was illustrated with a risk-portfolio diagramme.

- A reporting tool to help manage risks was programmed. Lekkerland can use this program independently, as well as keep it up to date with current data.